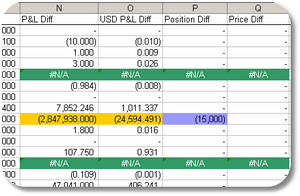

The system compares position, price and P&L figures received from several sources, and highlights discrepancies for attention by the fund manager.

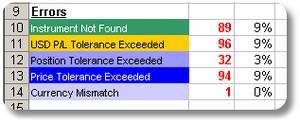

As well as these discrepancies, other error conditions can also arise. For example, an instrument may be missing from one data source, or it may be listed with the wrong currency. These errors are highlighted directly in the data, and summarised at the end of the reconciliation.

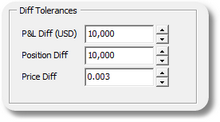

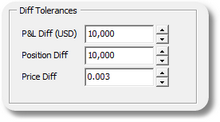

Small discrepancies are to be expected since separate data sources may report on different days, and these minor differences can often be ignored. To allow for this, the fund manager can configure tolerances — a discrepancy within the tolerance does not generate a warning.

Different organisations often use different identifiers for the same instrument. Our system recognises these variations using sophisticated pattern matching techniques.

This reconciliation used to be an extremely laborious process, in some cases taking a whole week of boring and error–prone visual inspection. Now our system does the hard work, and the fund manager need only investigate any highlighted discrepancies — and can do so with a clear head.